As a leading financial center in Asia, Singapore has been committed to building a global wealth management center, and even plays the role of a financial center in the world. Singapore is known for its low taxes and is known as a "tax paradise". It is one of the regions in the world that enjoys low tax rates.

Next, let's understand how Singapore's tax rate is different from that in China.

Taxpayers of personal income tax in Singapore are divided into two categories: resident individuals and non-resident individuals. The tax year for personal tax is the normal calendar year, 1 January to 31 December. The deadline for filing individual tax returns is April 15 of the following year.

Non-resident individual:

The annual residence time in Singapore is greater than or equal to 60 days but less than 183 days, all income obtained in Singapore will be taxed at 15%, or the tax amount is calculated at the local progressive tax rate, whichever is higher is the tax amount. Residing in Singapore for less than 60 days: then working income is tax-free.

However, this does not apply to company directors, public entertainers and professionals, director fees and other income of non-tax residents will be taxed at the current rate of 22%

Resident Individual:

Singaporeans, Singapore permanent resident PRs and foreign individuals who live or work in Singapore for more than 183 days (including 183 days) in a tax year; Singapore's personal income tax rate is among the lowest in the world, and the income tax rate is deducted from the previous year's income Taxes are progressively taxed after appropriate items. The tax rate is 0-22%, and the threshold is SGD 20,000.

Tax residents can enjoy personal income tax relief on matters such as child support, vocational training fees, insurance premiums, provident fund contributions, and charitable donations.

(Singapore resident personal income tax rate, 1 SGD is approximately equal to 5 RMB.)

Singapore's personal income tax is levied on a yearly basis. After the income is accumulated for 365 days a year, the tax rate also fluctuates according to the level of income. Before calculating taxes, first calculate your "taxable income," which is less than your gross income. Those whose "taxable income" is less than 20,000 SGD do not need to pay tax; those who exceed 20,000 SGD but less than 30,000 SGD do not need to pay tax for the first 20,000 SGD, and the excess part is levied a tax of 3.75% (according to tax/total income) Income calculation, the actual tax rate is lower than 1%); for those who exceed 30,000 and less than 40,000 Singapore dollars, the first 20,000 yuan does not need to pay tax, and the 10,000 between 20,000 and 30,000 is calculated at a tax rate of 3.75%, and the part exceeding 30,000 The tax rate is less than 5% (according to tax/total income, the actual tax rate is less than 2%); in short, the higher the income, the higher the tax rate, but the tax rate is only increased for income exceeding the previous level.

TIPS:

China's personal income tax collection items include income from wages and salaries; income from labor remuneration; income from author remuneration; income from royalties; income from business operations; income from interest, dividends, and bonuses;

According to Article 6 of the "Personal Income Tax Law of the People's Republic of China", the standard threshold for personal income tax is 5,000 yuan per month (ie 60,000 yuan per year).

Taxable income = monthly income - 5,000 yuan (threshold point) - special deductions (five insurances and one housing fund, etc.) - special additional deductions - other deductions determined by law.

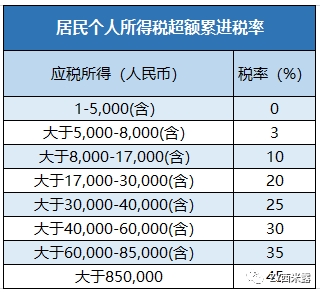

(Individual income tax rate for domestic residents)

In Singapore, most provision of financial services, digital payment tokens, sale and lease of residential properties, and investment in precious metals are exempt from GST. Exported goods and provision of international services enjoy zero GST tax rate.

Capital Gains Tax: 0

In Singapore, no matter whether it is corporate or personal capital gains (dividends, dividends, etc.), no tax is required, and the tax rate is 0.

TIPS:

China's stock dividend tax deduction is related to the length of time the stock is held, and the tax will not be deducted immediately after the dividend is distributed, and it will be deducted when the shareholder transfers it.

1. If the holding period is within 1 month (inclusive), the full tax burden on dividend income is 20%; 2. If the holding period is more than 1 month to 1 year (inclusive), the tax rate is temporarily reduced by 50% Included in the taxable income, the tax burden is 10%; 3. If the holding period exceeds 1 year, no personal income tax is required. Special circumstances: when there is no date with the same day in the previous month in this month, the period of one month shall be the natural day at the end of the month. Calculation formula for dividend tax: Dividend tax payment = total amount of cash dividends * tax rate + total number of stock dividends * face value (1 yuan / share) * tax rate [Special Note]: If only bonus shares are given, no cash will be distributed. Also tax deductible. However, there is no tax deduction for the conversion of the common reserve fund into share capital.

For taxpayers who work in Singapore or operate a business in Singapore, they must declare income tax to the Inland Revenue Authority of Singapore (IRAS) within the specified time.

How to reasonably avoid tax in the case of overseas asset allocation?

WAN wealth management has launched the WAN global asset allocation plan for those who have too many overseas assets or who want to achieve overseas asset allocation but face high taxes.

case:

Mr Li, a Chinese national, mainly operates manufacturing operations in Hong Kong and Singapore, and spends most of his time outside of China. The investments under his personal name are distributed in different jurisdictions, with a total amount of up to 20 million US dollars. Dividends, interest, and income are taxable items in China. Mr. Li chooses the WAN global asset allocation plan, which can save up to 20% of taxes and fees.